When I’ve been racking my brain to wonder which brands are still independent and ripe for purchase, Chantecaille has been amongst the first. Beiersdorf bought the brand, founded in 1997, back in December and the transaction is closing any day now. Beiersdorf owns Nivea, Eucerin and La Prairie to name a few, but if you ever want to know what’s on the beauty trend cards, it’s worth looking at the big names’ recent investments.

They also own an eco-messaging brand called Stop The Water While Using Me! (is anyone reminded of that shampoo classic, Gee, Your Hair Looks Lovely?), Chaul, a brand fuelled by ferment and O.W.N. which specialises in this year’s buzzword, personalisation. They’ve also got a male fragrance brand called Gammon which I have tried saying in various different language accents and no, it still sounds like gammon.

It’s already widely publicized that Glossier is having financial problems – actually, I feel a bit surprised by this. It’s one of the brands that BBB readers are most reactive to and one of my favourites. The brand has recently laid off 80 employees – a third of it’s corporate workforce, and that’s a lot to let go at once. It’s reported that the layoffs are heavy on the technology side where the brand hired too many people too quickly. Glossier grew to be a $400 million brand in just four years with significant investment and it looks like there is such a thing as too much money – money brains suggest that slow hiring leads to more sustainable growth rather than quick and bulk hiring that can lead to a quality issue.

I’ve reported a couple of times already that the Boots Walgreens Alliance is open to sale – current contenders are CVC and Bain Capita, both investment companies, who are prepared to join forces on the sale. It was rumoured at the end of last year that Tesco and Sainsburys were both considering throwing their hats in the ring but those speculations have died down.

BH Cosmetics has filed for bankruptcy. Launched in 2009, the colour brand is similar to Make Up Revolution in targeting gen Z consumers with bright colours and accessible prices. It’s probably best known for celebrity tie ins with Iggy Azalea and Doja Cat and if you’ve seen it in the UK, you’ve seen it on BeautyBay.

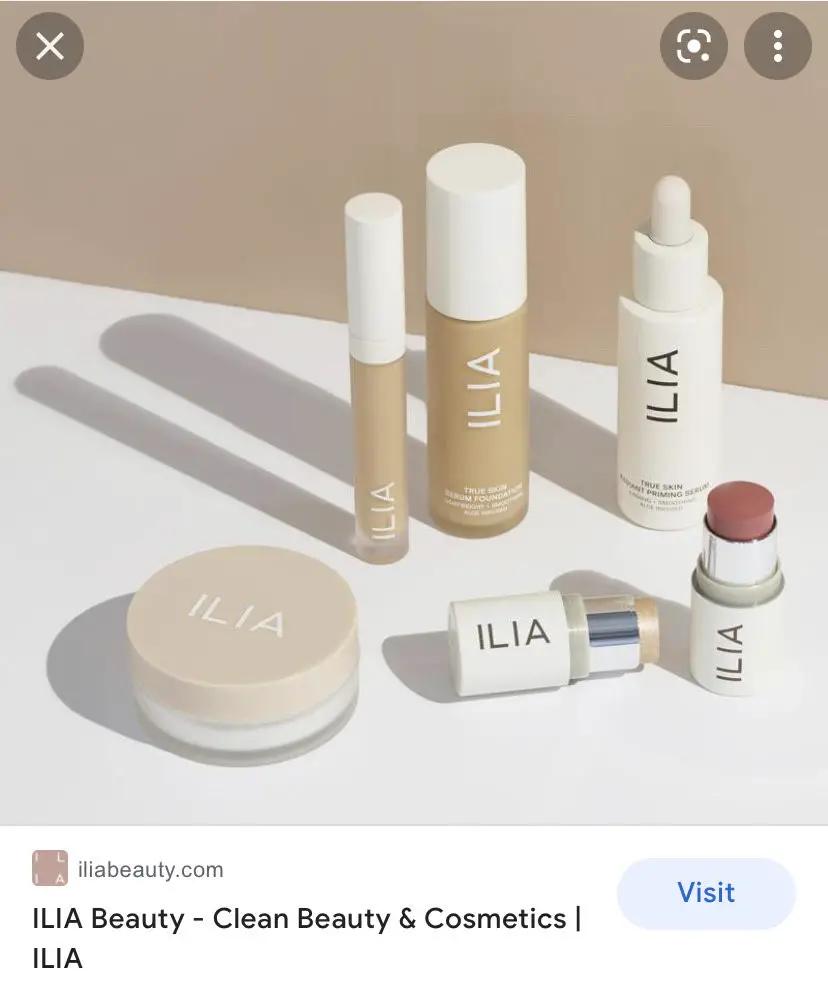

Ilia Beauty (main pic) has been bought by Famille C, the investment company belonging to the Courtin-Clarins family to bolster their ‘clean’ credentials. Also under the Clarins label is My Blend, a line built around ten ‘essential formulas’ using a diagnostic tool to create a personalised routine. It seems to be aimed at older women – which is where Clarins’ customer base lies – and I’ve neither seen nor heard much of My Clarins, the youth offering designed to bring on the coveted Gen Z.

THG (The Hut Group) has had a messy couple of years. The group acquired Cult Beauty last year for a reported £275 million but its shares have fallen by ¾ since last year with further ‘challenges’ expected throughout 2022. It’s thought that their nutrition division – energy drinks, supplements and protein shakes are facing higher ingredient costs.

While I was busy reporting that the L’Occitane Group had invested in a French underwear brand last month, I somehow missed that it has bought Sol de Janeiro of Brazilian Bum Bum Cream. Founded in 2015, L’Occitane has taken an 83% stake based on a valuation of $450 million.

P&G has recalled 32 products (dry shampoo and conditioner) from brands such as Herbal Essences and Pantene after finding traces of benzene affecting some of its products. It’s important to note that benzene is not an ingredient in any of the products but has been found in the aerosol propellant that sprays out the product. It’s a voluntary recall and you can find the specific products HERE.

Meanwhile, class actions are in progress against bareMinerals (recently offloaded from Shiseido to Advent International) for allegedly using false marketing to imply their products are clean and natural when they contain PFAs (per- and polyfluoroalkyl substances) which are though to be harmful. According to Truth In Advertising, products affected include BarePro Liquid Foundation and Gen Nude Matte Liquid Lipstick. I think this is the kind of class action that will pop up far more frequently as brands very easily throw the marketing term ‘clean’ into the ring when it doesn’t have any officially recognised meaning in beauty terms.

Leave a Reply